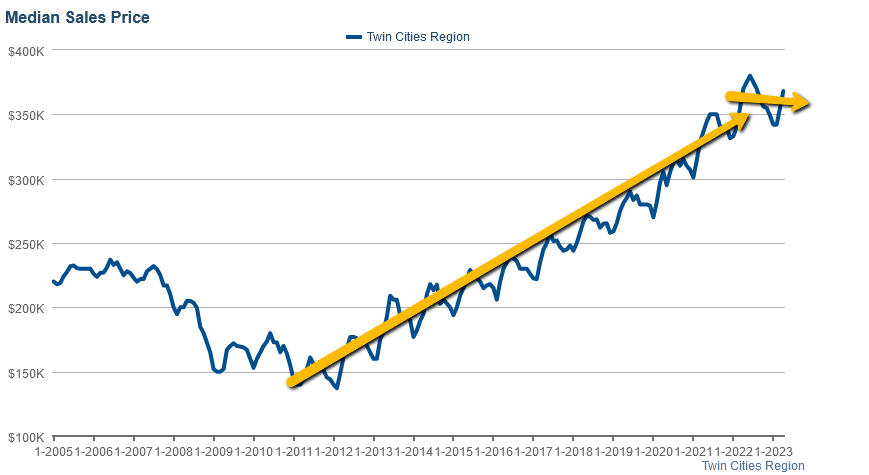

The seasonal tailwinds almost always bring home prices up in the spring from their winter downturns and this spring is no different in that regard as the Twin Cities' median home price moved up 3.6% in April. What is different this year, is that for the first time since 2011, home prices were down YOY in April. The higher interest rate regime which began in January of 2022, has caused a significant contraction in sales volume (this is the lowest sales volume we've had in April since 2008) and put a dampening on the bidding wars. With record-low inventory, home prices are holding up but this market is not likely to have enough steam to take out the June highs from 2022. If that forecast turns out to be correct, this will mark the end of an epic, 11 year bull market that caused home prices to rise 133%.

The Median Home Price: The Twin Cities' median home price moved up 3.6% in April to 368,000 but is down (.5%) in April for the first time since 2011 as higher mortgage rates continue to have a contractionary affect on the housing market.

The Median Home Price: The Twin Cities' median home price moved up 3.6% in April to 368,000 but is down (.5%) in April for the first time since 2011 as higher mortgage rates continue to have a contractionary affect on the housing market.

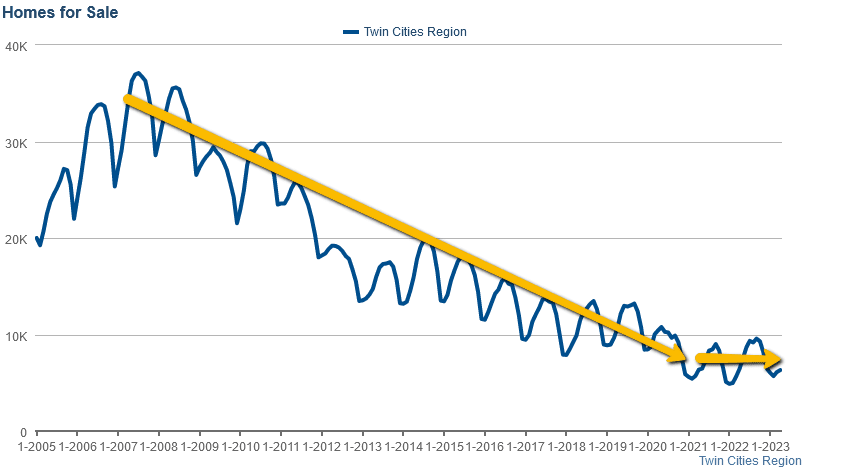

Home Inventory: The home inventory level in the Twin Cities moved up 3.7% in April to 6,353 units (homes, condos, and townhouses). That level is only up 1.3% YOY and remains historically, very low.

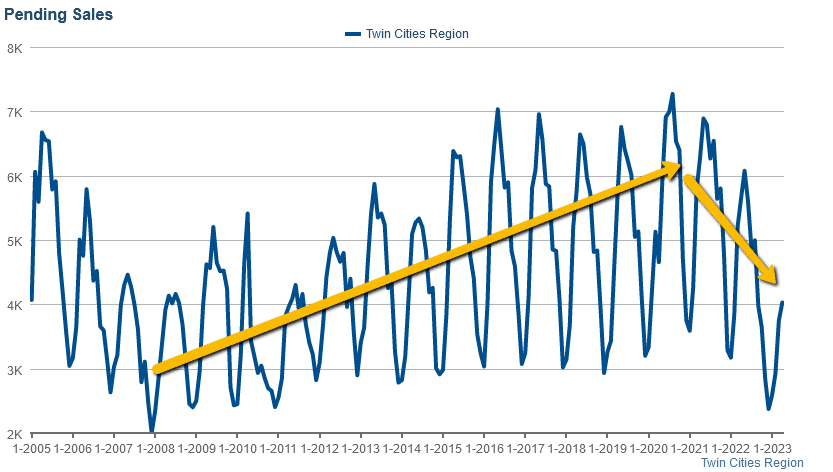

Pending Home Sales: 4,025 homes came under contract in the Twin Cities in April. That is up 7.5% MOM but down a whopping 28.8% YOY. That is the lowest level of April sales volume since April of 2008, as higher interest rates continue to have a contractionary impact on the housing market.

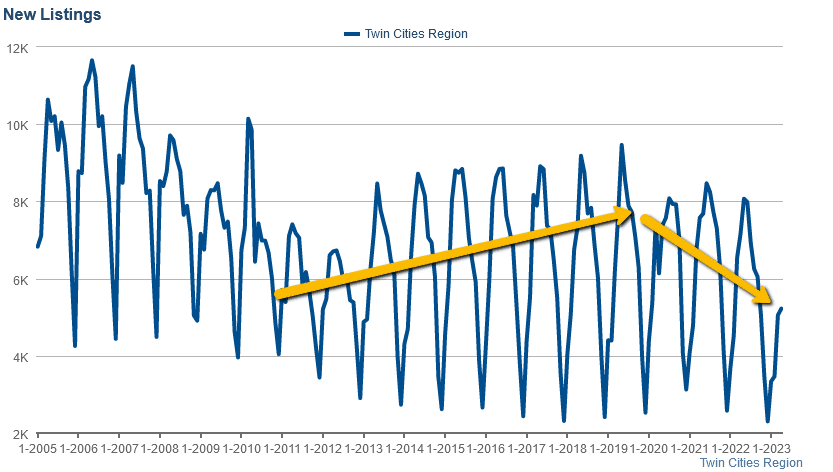

New Listings: 5,224 new listings hit the Twin Cities housing market in April which is up 3.3% MOM but down 27.2% YOY. Generally speaking, home owners who are locked into a sub-3% mortgage remain resistant to trading out to a 6% mortgage leaving the market with only the most motivated of movers.

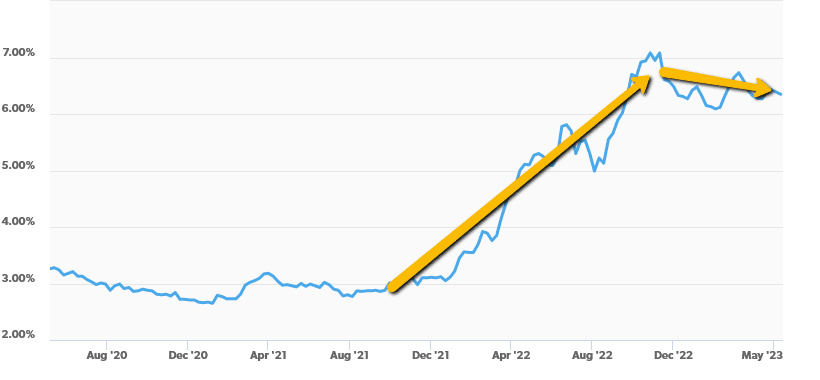

Mortgage Rates: The average 30-year fixed mortgage rate (for the week ending May 11th) of 6.35% is down 1.2% MOM and up 19.8% YOY. The cycle peak thus far for 30-year fixed rate was 7.08% back on October 27th of 2022 and long term rates have been cooling since then.

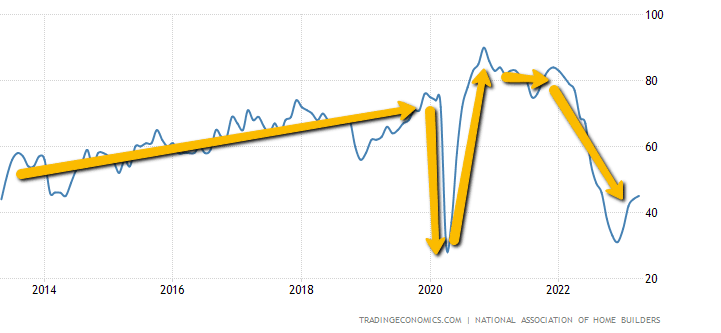

Home Builder Confidence: “The NAHB/Wells Fargo Housing Market Index in the United States rose by 5 points to 50 in May 2023, easily beating market consensus of 45. This marks the fifth consecutive month of growth and the highest level since July of the previous year, due to strong demand for new construction driven by limited housing supply. However, builders are still facing challenges in meeting this demand due to shortages of building materials like transformers, as well as tightening credit conditions for residential real estate development and construction, influenced by the Federal Reserve's interest rates hikes. The gauge for current single-family home sales was up 5 points to 56, while the home sales over next six months sub-index increased 7 points to 57. In addition, the gauge for prospective buyers rose 2 points to 33.” -National Association of Home Builders

This concludes my Twin Cities housing market insight for May of 2023. Please don't hesitate to call us at (952) 222-7653. if you would like to go more in-depth on a particular market segment or dive into the current fair market value of a property that you currently own or manage.

-Nick Leyendecker

Sources: NorthstarMLS, Infosparks Data, Hedgeeye Risk Management, FreddieMac.com, Nasdaq.com, TradingEconomics.com, fred.stlouisfed.org, The National Association of Home Builders

-Nick Leyendecker

Sources: NorthstarMLS, Infosparks Data, Hedgeeye Risk Management, FreddieMac.com, Nasdaq.com, TradingEconomics.com, fred.stlouisfed.org, The National Association of Home Builders