You can track the Twin Cities housing market data here. You can track mortgage rates here. You can track homebuilder confidence here. You can track lumber prices here.

The Twin Cities housing market cycle appears to be normalizing as pandemic-related impacts continue to dissipate. If that normalization process is fulfilled, it will restore some of the lost predictability to the market cycle and make home buying and selling decisions based on timing, easier to make.

There continue to be underlying macroeconomic conditions like a rapidly rising CPI, rising bond yields, GDP growth question marks, and Federal Reserve decisions regarding monetary policy that will continue to evolve and have ranging impacts on our local housing market but those factors have historical reference points to a degree, unlike the unprecedented pandemic related impacts and policy decisions (both monetary and regulatory) that were made by governments and central banks around the world, in response to the pandemic.

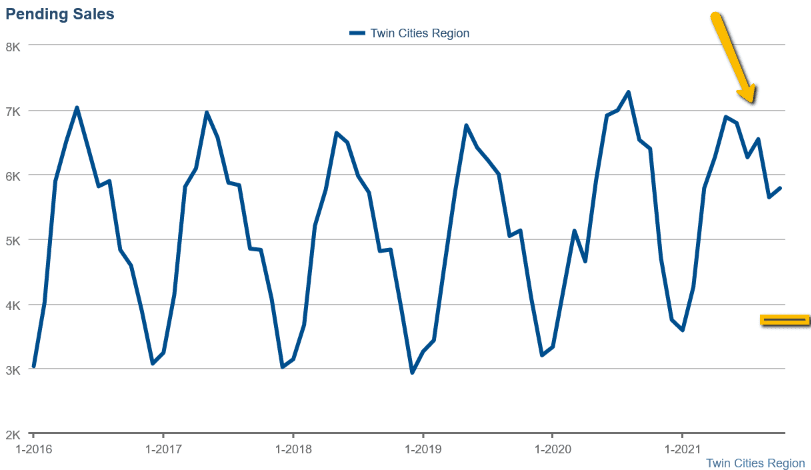

With the above in mind, we expect the seasonal correction that is currently underway for Twin Cities home prices to continue through January as housing inventory consolidates, setting up another bullish spring market. We expect that pending sales will start to turn around from their anticipated winter lows sometime between mid-January and early February 2022 and we expect prices for closed sales to be officially in an upward trend by February's month end, although 2021 peak pricing probably won't be recovered until sometime in March of 2022, for closed sales prices.

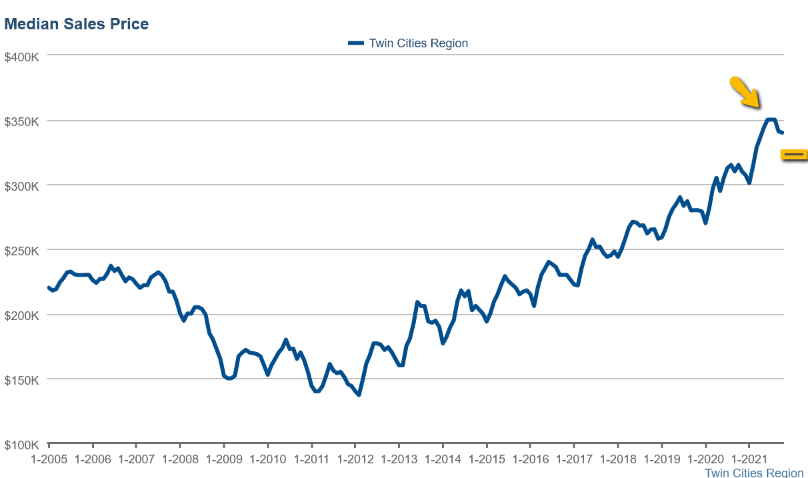

The Median Home Price: The median home price continued to correct in October falling .3% from the previous month to $340,000. That is up 8% from last October and up 48% over the past 5 years.

There continue to be underlying macroeconomic conditions like a rapidly rising CPI, rising bond yields, GDP growth question marks, and Federal Reserve decisions regarding monetary policy that will continue to evolve and have ranging impacts on our local housing market but those factors have historical reference points to a degree, unlike the unprecedented pandemic related impacts and policy decisions (both monetary and regulatory) that were made by governments and central banks around the world, in response to the pandemic.

With the above in mind, we expect the seasonal correction that is currently underway for Twin Cities home prices to continue through January as housing inventory consolidates, setting up another bullish spring market. We expect that pending sales will start to turn around from their anticipated winter lows sometime between mid-January and early February 2022 and we expect prices for closed sales to be officially in an upward trend by February's month end, although 2021 peak pricing probably won't be recovered until sometime in March of 2022, for closed sales prices.

The Median Home Price: The median home price continued to correct in October falling .3% from the previous month to $340,000. That is up 8% from last October and up 48% over the past 5 years.

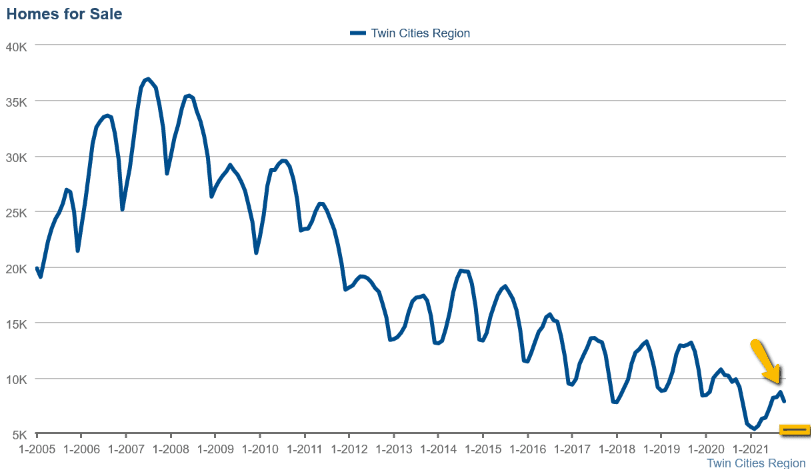

Home Inventory: One of the biggest distortions the pandemic had on housing was a deep suppression of new listings and therefore, the inventory level. One of the reasons I believe that the market is normalizing is that in 2021, inventory followed the prevailing historical trend by steadily rising with the market through September and then initiating a downtrend in October. As such, home inventory fell 9.5% in October, initiating what I believe to be the seasonal contraction which will likely have inventory continuing to contract until February/March.

Pending Home Sales: Pending home sales rebounded up 2.5% in October. A minor fall rebound for sales is not uncommon for October as this also happened in 2018 and 2019. Pending sales numbers will likely continue to decline from now through February.

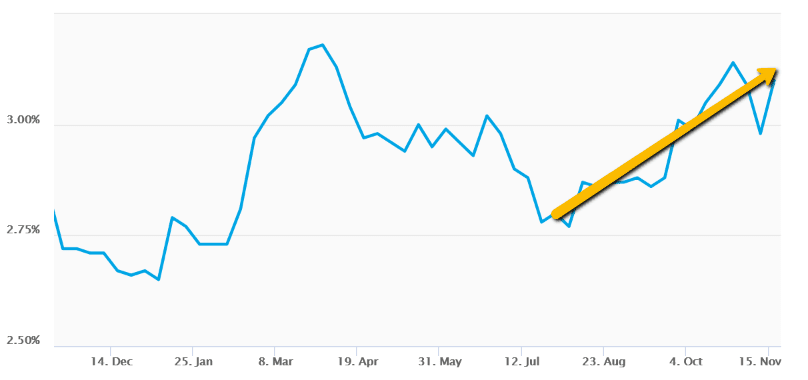

Mortgage Rates: As of late, there has been some unusual volatility in the bond market due to inflation concerns which has led to increased volatility in mortgage rates. On net, mortgage rates have been moving up since mid-July and currently sit at 3.10% for the average 30-year conventional mortgage in the United States which is just 2.5% below the 12-month high. The Fed's $120 billion per month bond purchasing program (a reaction to the pandemic) which includes direct buying of mortgage-backed securities (which will begin to be tapered down next month) is putting downward pressure on mortgage rates, however, if the Fed completely removes that ongoing support and/or if inflation continues to persist, catalysts for rising rates will continue to exist. With the amount of debt in the system and with asset prices inflated to record valuations as a result of their continual policy of easy money, I don't believe the Fed is actually in a position to tighten monetary policy (I think they can only bluff) so I think that any significant rise in the long term interest rates will prompt a return to the $120 billion per month support if not an increased level of support.

Lumber Prices: Lumber prices have been steadily moving up since they bottomed out back in August but just in the last week, they have moved up 29% which begs the question, is inflation transitory, or is inflation a monetary phenomenon that will persist until real, meaningful monetary tightening occurs? If lumber price inflation sustains, that will be bearish for home builder profitability, home builder confidence, and housing inventory, which would be bullish for existing home prices.

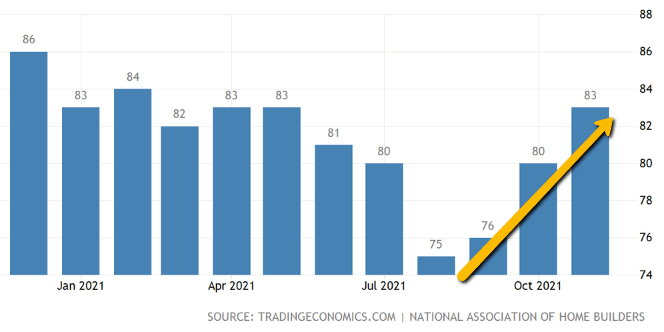

Home Builder Confidence: The NAHB housing market index in the US has been recovering since lumber prices bottomed out in August. The index rose three points to 83 in November of 2021, the highest in six months, beating market forecasts of 80 as demand for homes remains strong despite higher prices and longer wait times. I think that rising interest rates and persistent price inflation of raw materials will be the biggest factors to keep an eye on with regard to building confidence in 2022 and into the future.

This concludes my Twin Cities housing market insight for November of 2021. Please don't hesitate to call us at (952) 222-7653 if you would like to go more in-depth on a particular market segment or dive into the current fair market value of a property that you currently own or manage.