You can track the Twin Cities housing market data here. You can track mortgage rates here. You can track homebuilder confidence here. You can track showing activity here. You can track the showing volume here.

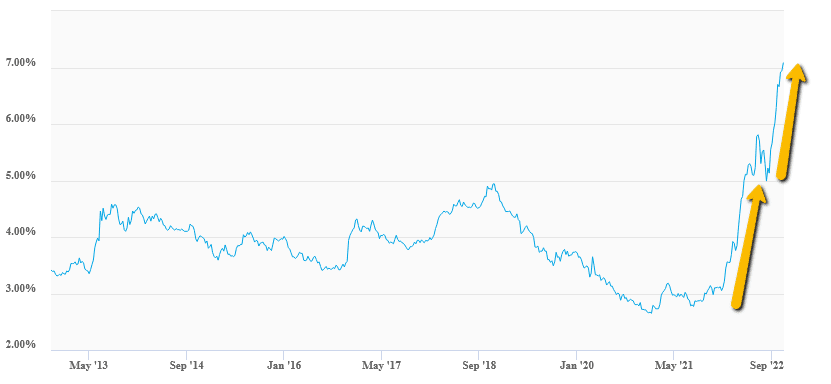

The 30-year fixed mortgage rate in the U.S. has risen above 7% for the first time since April of 2002, more than 20 years ago. Having begun the year at 3%, from a rate of change perspective, this is the largest and fastest rise in mortgage rates in U.S. history. Mortgage rates have now clearly broken out of a 41-year declining trend that began back in 1981.

This dramatic rise in mortgage rates YTD has caused demand to collapse almost 40% YTD in 2022, to a 9-year-low. The higher interest rates have also put downward pressure on new listings which has so far helped to maintain supply/demand balance and hold prices up, despite the massive rise in the cost of capital. Home prices remain in a seasonal correction but have not yet broken out of the current, 11-year bullish trend which began back in 2012.

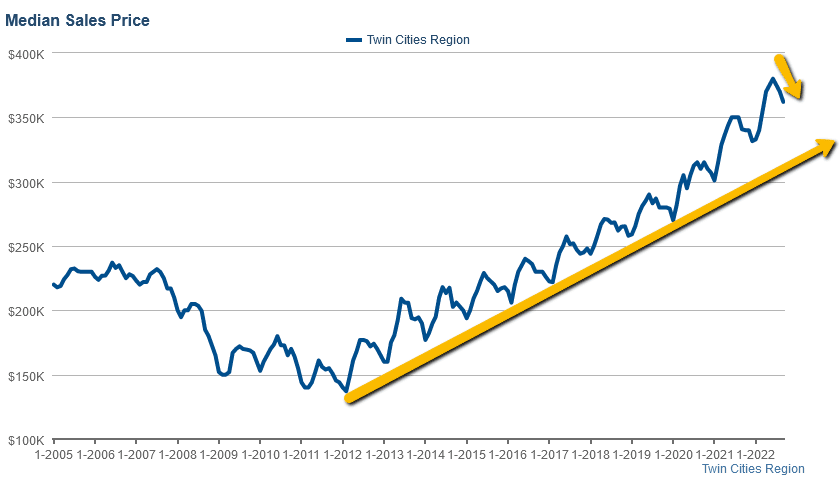

The Median Home Price: The median home price fell 2.1% in September to $362,050 as the seasonal market correction continues in most segments of the Twin Cities housing market. $362,050 is still up 5.8% YOY so the broader bullish trend in home prices has yet to be broken. Dramatic increases in mortgage rates have caused demand to collapse to a 9-year low in 2022, but near-record-low inventory is helping to keep prices up despite the significant rise in the cost of capital. We expect the median home price to continue to correct through January of 2023 before turning back bullish in February of 2023.

This dramatic rise in mortgage rates YTD has caused demand to collapse almost 40% YTD in 2022, to a 9-year-low. The higher interest rates have also put downward pressure on new listings which has so far helped to maintain supply/demand balance and hold prices up, despite the massive rise in the cost of capital. Home prices remain in a seasonal correction but have not yet broken out of the current, 11-year bullish trend which began back in 2012.

The Median Home Price: The median home price fell 2.1% in September to $362,050 as the seasonal market correction continues in most segments of the Twin Cities housing market. $362,050 is still up 5.8% YOY so the broader bullish trend in home prices has yet to be broken. Dramatic increases in mortgage rates have caused demand to collapse to a 9-year low in 2022, but near-record-low inventory is helping to keep prices up despite the significant rise in the cost of capital. We expect the median home price to continue to correct through January of 2023 before turning back bullish in February of 2023.

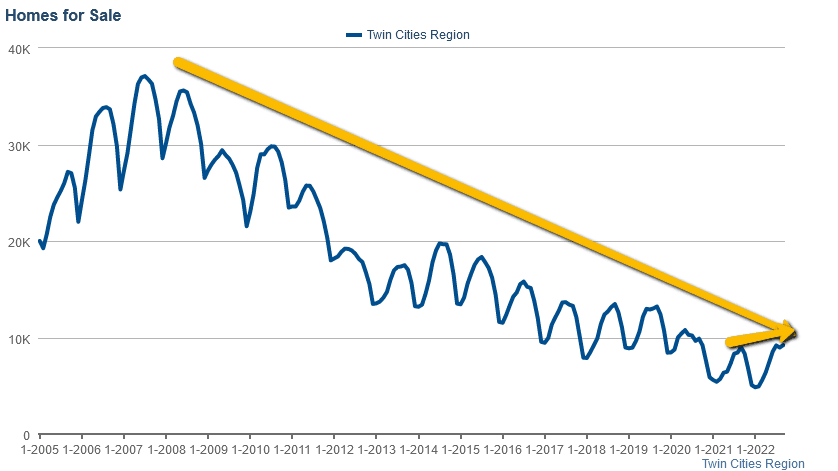

Home Inventory: The home inventory level in the Twin Cities moved up 2.8% in September to 9,212 units. That level is also up a marginal 2.8% YOY but remains very low, historically. High-interest rates have put downward pressure on new listings as move-up or move-down prospects have been hesitant to trade out of a 3% mortgage for a 7% mortgage. The potential risk factors that could contribute to a rise in inventory down the road are 1) persistent inflation continuing to eat away at disposable income making mortgage payments harder to make or 2) the job market collapsing, which so far has been holding up, despite shrinking corporate profits YTD. Inventory is sort of the key to the current housing market dynamic, if inventory stays low, prices are not likely to crash due to rising rates but if inventory breaks out to the upside, that would change the game.

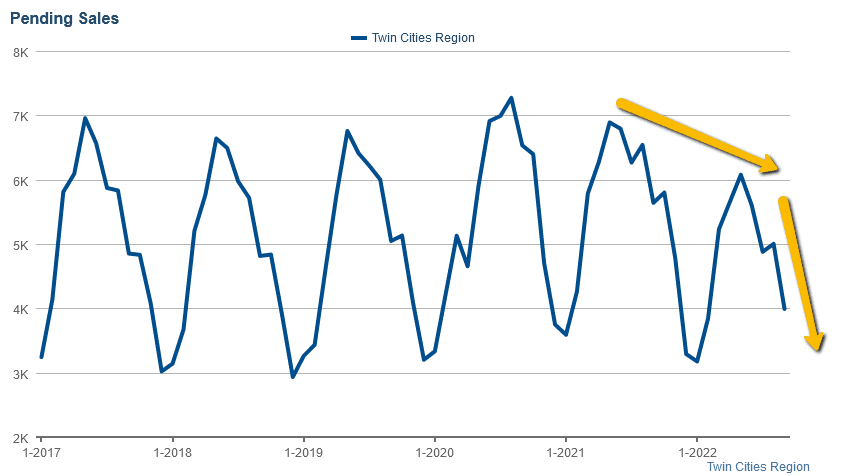

Pending Home Sales: 3,991 homes came under contract in the Twin Cities in September. That is down a whopping 20% MOM and down 32% YOY as higher interest rates and higher prices continue to strain demand and overall sales volume. We expect pending sales to continue to decline through December or January before turning back up into the spring of 2023.

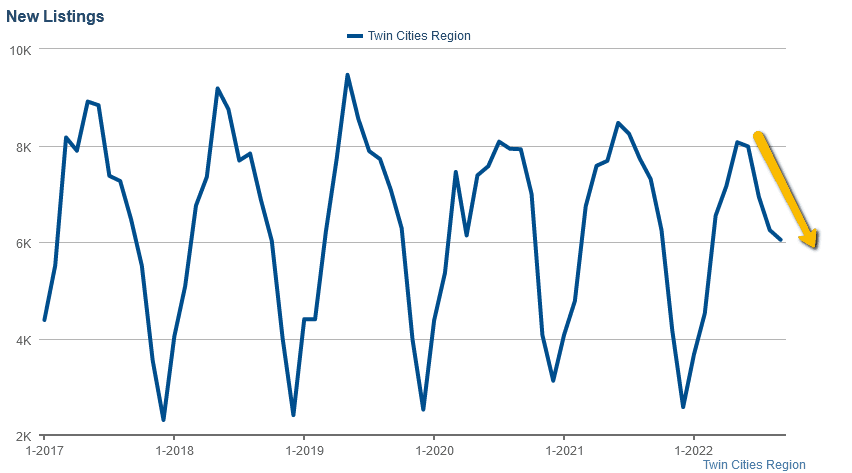

New Listings: 6,047 new listings hit the Twin Cities market in September which is down 3.2% MOM and down 17% YOY. Collapsing affordability is primarily impacting demand but it is also impacting new listings as some move up and move down buyers are deciding to stay in their current homes in the face of the higher prices and rates. So long as new listings continue to fall dramatically alongside demand, that will keep a floor under housing prices during the off-season, in this September data, the decline in new listings is starting to diverge from the decline in pending sales we'll have to keep an eye on that.

Mortgage Rates: The dramatic rise in mortgage rates cooled off from June through mid-August but since August 18th, rates have been once again raging higher. The average 30-year-fixed mortgage in the U.S. as of October 27th, 2022 is 7.08%, up a whopping 40% since August 18th and up a whopping 125% YTD. The last time mortgage rates were at or above 7% was back in April of 2002, more than 20 years ago. If the Fed remains committed to fighting inflation regardless of declining economic data, interest rate volatility is likely to continue into 2023.

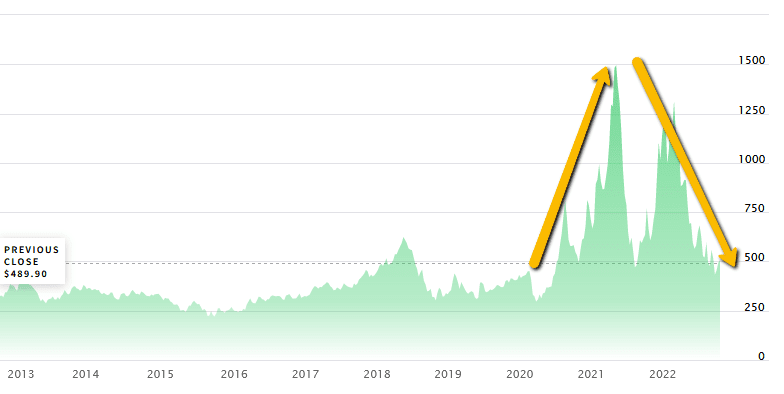

Lumber Prices: Lumber prices appear to have stabilized back to within a pre-pandemic range after having more than quadrupled during the pandemic.

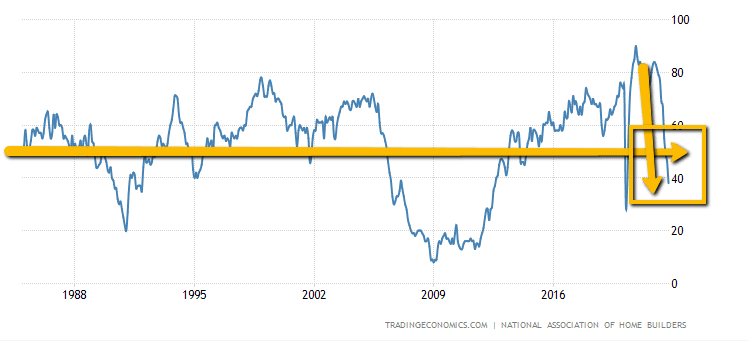

Home Builder Confidence: "The NAHB housing market index in the US fell for the 10th straight month to 38 in October of 2022, half the level it was just six months ago and below market forecasts of 43. This was the lowest reading since August 2012, except for the onset of the pandemic in the spring of 2020, due to rising interest rates, building material bottlenecks, and elevated home prices. Current sales conditions fell 9 points to 45, sales expectations in the next six months declined 11 points to 35, and traffic of prospective buyers fell 6 points to 25. “High mortgage rates approaching 7% have significantly weakened demand, particularly for first-time and first-generation prospective home buyers,” said NAHB Chairman Jerry Konter, a home builder and developer from

Savannah, Ga." Source: National Association of Home Builders

This concludes my Twin Cities housing market insight for October of 2022. Please don't hesitate to call us at (952) 222-7653 if you would like to go more in-depth on a particular market segment or dive into the current fair market value of a property that you currently own or manage.

Sources: NorthstarMLS, Infosparks Data, Hedgeeye Risk Management, FreddieMac.com, Nasdaq.com, TradingEconomics.com, fred.stlouisfed.org

Sources: NorthstarMLS, Infosparks Data, Hedgeeye Risk Management, FreddieMac.com, Nasdaq.com, TradingEconomics.com, fred.stlouisfed.org